Abstract

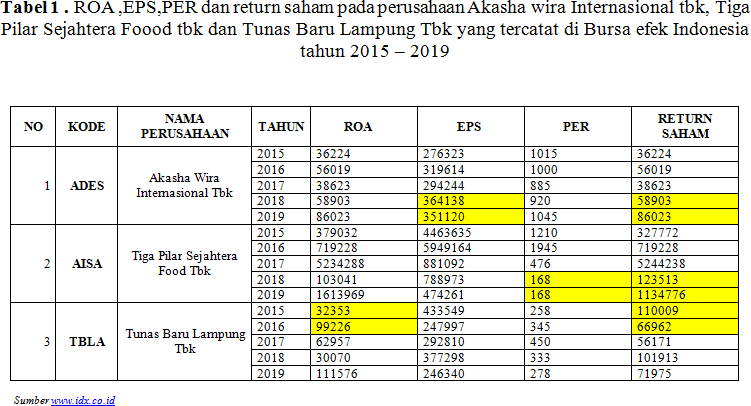

This study aims to determine and analyze the effect of Net Profit (ROA), Current Assets (EPS) and Stock Price (PER) on Stock Return of Food and Beverages Companies listed on the IDX in 2015-2019. The research method used in this research is quantitative research methods, the type of research is descriptive quantitative. The population in this research are all Food and Beverages companies with a sample of 20 companies. The data analysis method used in this study is the multiple linear regression method and the classical assumption test. The results of this study show that simultaneously Net Profit (ROA), Current Assets (EPS) and Stock Price (PER) have a significant effect on Stock Return of Food and Beverages Companies listed on the IDX in 2015-2019 with a significant value of 0.000 <0.05. Partially Net Profit (ROA) has a positive and significant effect on Stock Return with a significant value of 0.000 <0.05. Partially Current Assets (EPS) has a positive and significant effect on Stock Return with a significant value of 0.042 <0.05 and partially Stock Price (PER) has a positive and significant effect on Stock Return with a significant value of 0.000 <0.05. It is hoped that the results of this study can be input for investors in looking at stock returns

company

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright (c) 2023 Lembaga Layanan Pendidikan Tinggi Wilayah X