Abstract

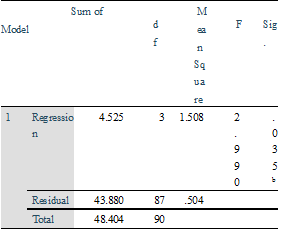

Companies must improve work effectiveness and efficiency to survive. The business wants earnings to ensure its existence. This research looked at the impact of the quick ratio, debt ratio, and inventory turnover on return on assets in businesses listed on the Indonesian Stock Exchange from 2016 to 2019. This study utilizes quantitative and categorical data. Collecting data using literature. This study covers 52 consumer goods firms listed on the Indonesian Stock Exchange from 2016 to 2019. The sample is 23. As a consequence, the Quick ratio has no impact on the return on assets of firms listed on the Indonesia Stock Exchange from 2016 to 2019. For the 2016-2019 timeframe, the debt ratio has no impact on the return on assets of firms listed on the Indonesia Stock Exchange. For the 2016-2019 timeframe, inventory turnover affects return on assets in the Consumer Goods Sector. Ongoing changes in debt ratios and inventory turnover impact return on assets in Indonesian consumer goods businesses

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright (c) 2023 Lembaga Layanan Pendidikan Tinggi Wilayah X