Abstract

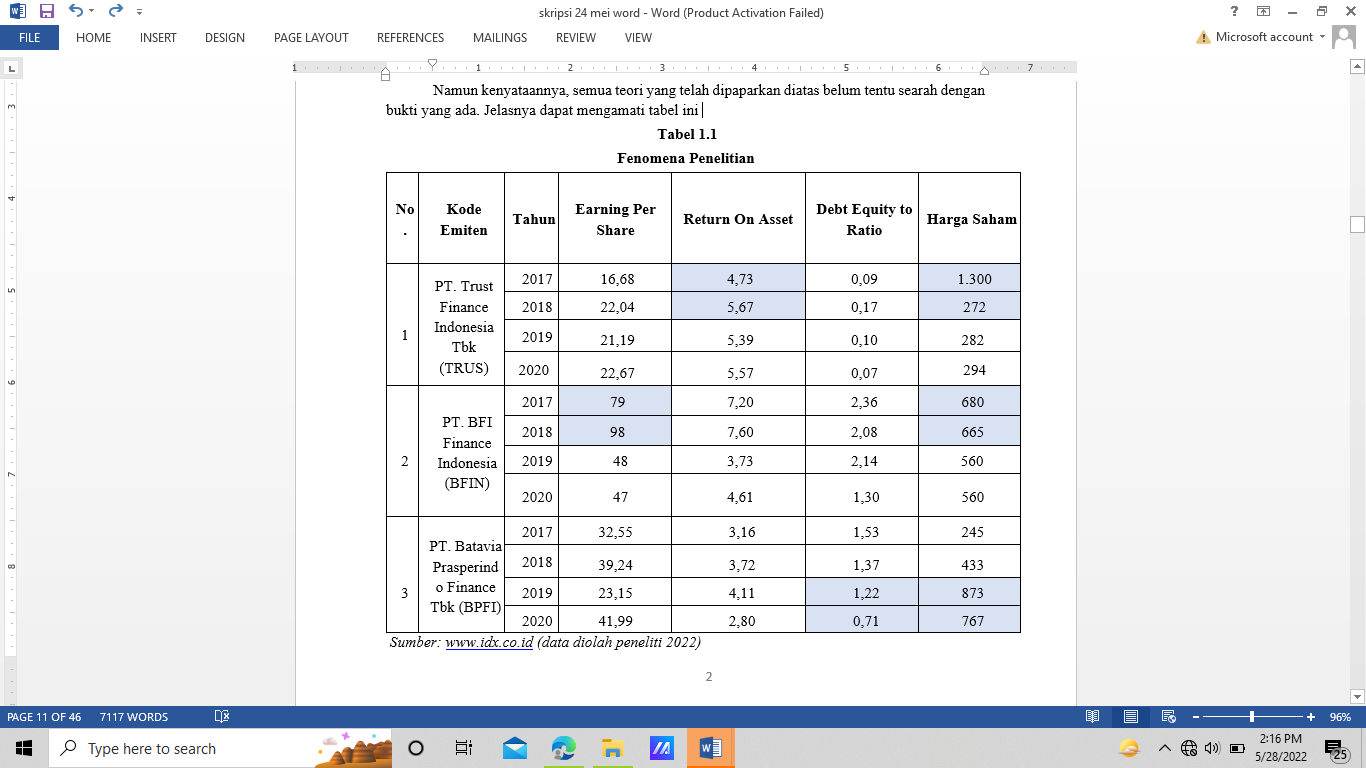

The goal of this insvestigation is to examine the impacct of earnings per share, return on assets, debt/partial equity ratio, and also stock price in companies in the Corporate Governance sub-sector financial institutions traded on the Indonesia Stock Exchange in 2017-2020. This investigation used a sample of 44 financial institution subsectors for the period 2017-2020 and a total of 19 financial institution subsectors registered with IDX on period 2017-2020. The method used in this insvestigation is quantitativ research. Use default data available on IDX official website as financial report. The purpose of sampling was to establish the type of sample included in this investigation. Multiple linear regression methods used by researchers to analyze the results of a investigation will be learned and concluded. The revenue investigation shows that the share prices of establishment in the financial institution sub-sector in the period 2017 - 2020 are partially positively and directly related to EPS, while the increase or decrease in stock prices of companies in the financial institutions sub-sector in the period 2017-2020 is partly related to stock prices. It is not affected by ROA or DER. The revenue of this investigation concluded that EPS, ROA, and DER also had a signifikation impact on the stock prices of Financial Institution companies traded on the Indonesian Stock Exchange during the period 2017-2020.

This work is licensed under a Creative Commons Attribution 4.0 International License.

Copyright (c) 2023 Lembaga Layanan Pendidikan Tinggi Wilayah X